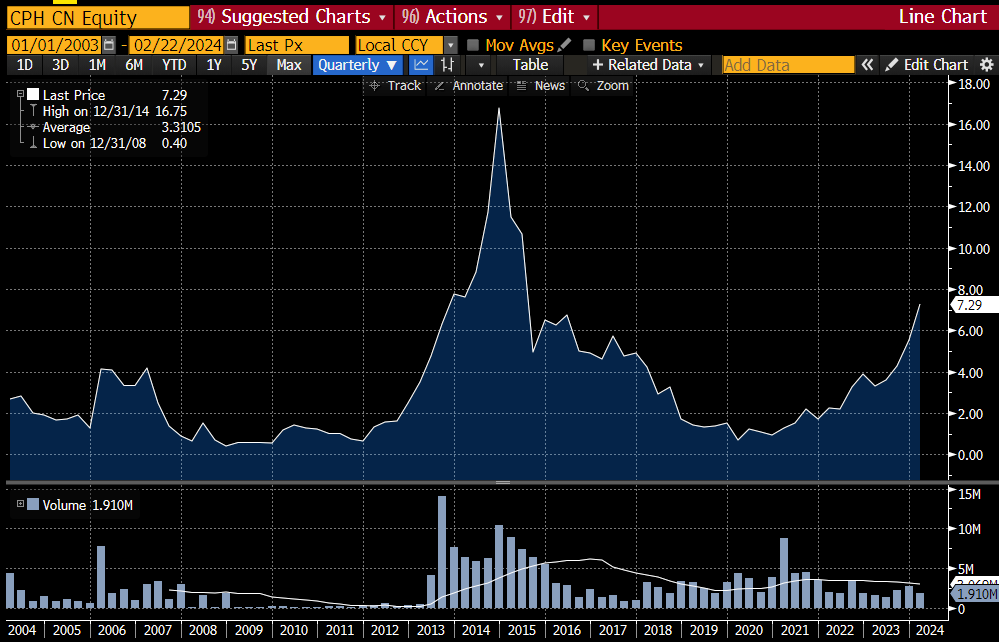

Cipher Pharmaceuticals (CPH CN)

Diving deep in to the world of micro caps for the first time. I am not going to lie, the idea that someone might ask in 5 years time: “How did you make your fortune?” And I might be able to reply “nail fungus!”, really appealed to me.

Cipher (C$170mn mkt. cap.) is a growing, asset-light, cash generative Canadian pharmaceutical, with aligned management, buying-back shares and trading at a ~15-20% FCF yield. So the stock just looks cheap already, but the real kicker is a late stage topical nail fungus treatment which is expected to more than treble op. profit by FY27.

I’m a member of MicroCapClub, where I first discovered the idea, I’d also thank

who has an excellent write-up here, if you want more than this basic summary.As a reminder this is primarily an investment journal, this is not financial advice or a recommendation. All of the ideas are plundered from other (cited) sources. I simply own the stock. Please refer to the disclaimer at the bottom or my introductory post for further details.

Average entry price: C$7.15

Current price: C$7.01 (as of 1-Mar)

Upside scenario: ~C$20+ (~3x, 2-3 year horizon)

Position size: ~$10k

Description

Cipher Pharmaceuticals is a Canadian specialty pharmaceutical company which primarily derives its revenue from an oral retonoid acne treatment. It operates an “asset light” model and attempts to in-license/acquire promising late-stage products. It was founded by John Mull in 2003, his son is CEO and the Mull family own over 40% of the share capital.

Investment thesis and catalysts

Current business doing just fine: Latest results demonstrate the strength of the existing franchise, 3Q: revenues/EBITDA/EPS +27%/+37%/+170% y/y. YTD Cipher generated $13.5mn in operating cash flow and spent zero capex. It operates an asset light model, with promising drugs periodically acquired. While these growth rates are unlikely to be sustained, it is not a melting ice cube (as was the case previously driven by the US). YTD the company has bolstered its cash balance from $13mn to $42mn (on a $130mn mkt. cap.) The company is growing and highly FCF generative. The existing business is driven by Absorica/Epuris an oral retinoid indicated for the treatment of severe nodular and/or inflammatory acne. It is the #1 retinoid in Canada (46% mkt share) because of its better absorption and, unlike other retinoids, it does not need to be taken with food. The Canadian product has been protected from generic competition because of lower prices and a smaller market. As a result it has consistently grown market share. In the US, market share has been growing from a low base following a period of rapid declines as a result of generic competition. A licensing agreement in Mexico provides another opportunity for growth. Currently Absorica/Epuris account for ~85% of revenues.

Phase 3 nail fungus: pharmaceuticals provide me with exactly zero edge. So I’m reticent to speak too much about the likelihood of approval. I’ll simply lay out my thinking and what I’ve read elsewhere. The drug is called MOB-015, developed by Moberg Pharma, Cipher owns the Canadian rights. It’s currently in Phase 3 trials in NA with results by Jan-25. First and foremost it has already been approved in 13 other European countries. Secondly the drug already had Phase 3 trials in NA and met all primary end points but had some nail discoloration issues, thus it is running them again at lower dose. Trial enrolment was completed ahead of schedule, which is usually a further encouraging sign. There is only one existing drug for nail fungus (Jublia) which is it has significantly outperformed in trials, the existing treatment is not well tolerated and takes treatment for many months for a noticeable effect. The potential for the product is very large, the current prescription market is CAD80mn and growing. However, this probably understates the opportunity given many cases currently go untreated because the lack of a well tolerated and effective treatment option.

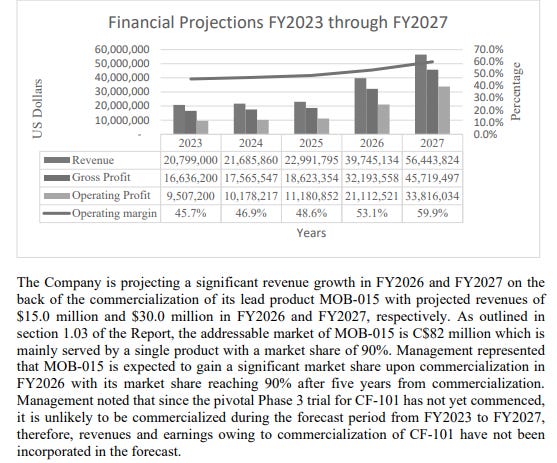

dug the below out of the SIB offer document showing a third party assessment of value… MOB-015 is expected to drive a tripling of earnings.The other main, promising pipeline product is CF-101 for plaque psoriasis ($450mn moderate-severe market in Canada). Pivotal Phase 3 trial results expected by FY26. However, given the time-line (revenue 2028+), I’ll leave this one for now.

Aligned management: The founding Mull family own 40% of the share capital. The turn-around has been driven by Craig Mull who took the helm in 2019, after a period of outsourced management. The share buy-back announced in Sep-23 (1.29mn/5% of capital stock, C$4.64) and again in Nov (for up to 10% of shares), supports my view that the Mulls are appropriately aligned, incentivised and see significant value in the stock.

Valuation underpinned, pipeline a free option: The best way to look at this: value the stand-alone business and then look at the pipeline as an option. All the following is in US$. CPH has a $130mn market cap (@7.29 $CAD per share). Net of $42mn of cash this is a ~$90mn EV. The stand-alone business should generate at least $15mn of FCF, or more likely close to $20mn on an 3Q run-rate basis, equivalent to 4.5-6x/17-22% FCF yield. For a stable to growing business this seems too cheap already, 10-12% FCF yield would be more reasonable IMO. Furthermore with no debt, a large cash balance, and a share buy-back in progress, this gives you a large margin of safety and a path to realise stand-alone upside of >50%. Now the real kicker is in the MOB-015 cited above. CPH is expecting $30mn of MOB-015 revenues by FY27, the main driver behind a $23mn increase in EBIT. On the same multiple this would imply an additional $220mn of value (on a $90mn EV). This fails to account for multiple accretion from projected growth and accrued FCF/buy-backs. Taking both of these into account implies the stock could easily be >4x from here on MOB-015 alone. This may take a couple of years to play-out but I think it is worth the wait given the risk-reward dynamics.

Risks

Nail fungus failure: while it appears unlikely based on the above I am not an expert. No matter that I think the stock is cheap stand-alone, it would undermine the thesis for most investors.

Unexpected core business competition: the core business has suffered in the US in the past from generic competition. While the bulk of this appears to be behind them further pressure on other products cannot be ruled out.

Poor capital allocation: value destructive M&A (as was the case with prior management) could undemrine the investment case. However buy-backs are a promising sign.

Credits, sources and where to find more

I’m a member of MicroCapClub, where I first discovered the idea.

who has an excellent write-up here, if you want more than this basic summary.On Twitter @DakotasTwits also has some great information, worth a follow.

Happy hunting,

The Geez