Alpha Metallurgical Resources (AMR US)

Investing is simple. Superior investing returns are driven by non-consensus views that turn out to be accurate. Simple but not easy. So where is there a big difference between perception and reality?

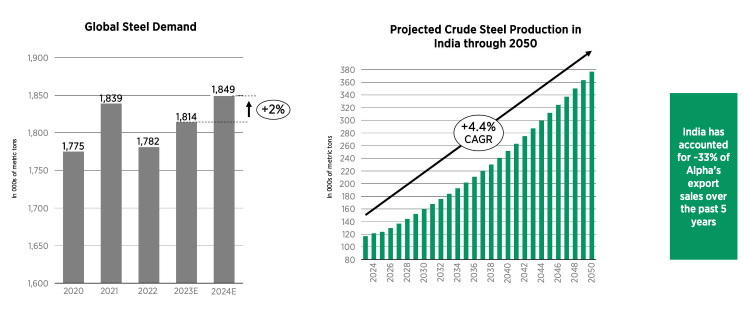

I think coal fits the bill. Western governments have been reducing thermal coal consumption for several years as part of decarbonisation efforts. The typical investor, or individual, in the West could be forgiven for thinking that coal was in terminal decline. However this is not the case with record consumption last year as China, India and South East Asia more than pick-up the slack. Met. coal consumption is growing and is expected to do so for many years to come.

Coal investments have been demonised with religious zeal by ESG fanatics. They have largely been successful in this endeavour as coal is virtually un-investable for most European funds. Tick-box ESG approaches create a number of problems but also opportunities. Coal provides cheap energy to people who would otherwise be in abject poverty with no electricity, clean water or other basic amenities. This is often completely ignored in favour of a single factor obsession (carbon emissions). However, this isn’t likely to change and I digress. The point is, relentless capital exiting the sector means i) the stocks trade cheap and ii) there is very little capital available for new supply, especially in the West.

So we have a sector in which: 1. demand is growing contrary to most people’s beliefs, 2. there is a restriction on capital for new supply and 3. for purely ideological reasons the stocks trade cheap. This is a nice setup, now to find a way to play it.

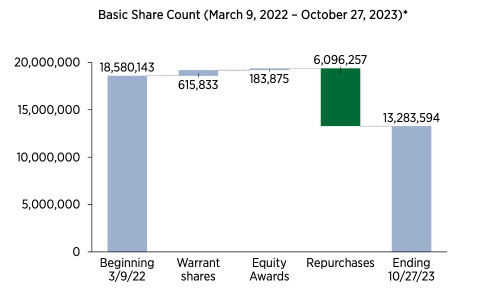

I came across AMR because of Mohnish Pabrai’s investment. It is a pure play met. coal producer and most importantly of all, it is hammering the share buy-back button. In Pabrai’s words an “uber cannibal”. From Mar-22 to Oct-23 AMR has re-purchased 28% of its stock. Over the coming years, with no debt, AMR could feasibly reduce the share count >50%, providing significant upside for shareholders.

AMR

Average entry price: ~$224

Current price: $364

Upside scenario: ~$720-$1,000 (+2-3x, 3 year horizon)

Position size: ~$10k

Description

Alpha Metallurgical Resources (AMR) is a US listed metallurgical coal producer. AMR accounts for nearly a quarter of total US met. coal production with 21 mines, annual production of ~16mn tons and reserves quoted at 323mn tons. It has a market cap. just shy of $5bn with no balance sheet debt.

Investment thesis and catalysts

Demand growing, met. vs. thermal. Metallurgical (met.) coal is used for the production of steel, while thermal is used for the production of electricity. Thermal coal has been more in the crosshairs of the ESG community and AMR has sold or shut-down all of its thermal coal production. Thus, going forward, AMR is entirely focussed on met. coal. Met. coal demand here is less exposed to renewable competition (electric arc furnaces are expensive) and demand is expected to continue to grow in the medium-term. Massive Chinese construction tailwinds are a thing of the past but India is expected to pick-up much of the slack.

A low cost producer. AMR produces met. coal at an average cost of ~$110-115 per ton. The met. coal price is volatile and sensitive to economic conditions (among other things) but is currently at ~$260 per ton (US East Coast Coal low vol). AMR produces around $16mn tons of thermal coal. AMR has 323mn tonnes of met. reserves, implying 20 years worth at current annual production.

Supply constrained: Coal production is projected to fall over the coming years, reflecting further declines in the West and a reduction in Chinese production. Environmental and regualtory obstacles make new mines hard to get approved, if they can get to approval, they come at greater cost and thus necessitate higher prices. Meanwhile the capital available to many producers is severeley constrained by Western ESG concerns. As such, I think the vast majority of capital will continue to be applied to shareholder returns, limiting future supply.

Valuation and debt: AMR has no long-term debt and as per above is a low cost producer. This affords flexibility and time. If prices decline or the economy slows down, one can afford to be patient. With a market cap. of $4.8bn AMR trades on a 8x FY24 EBIT multiple. In round numbers going forward let’s assume $150 average met. coal price (~ 10y average), gross cost per ton of $100, 16mn tons shipped, so $800mn gross profit. AMR guide for: ~$100mn of other costs (SG&A, minorit contributions etc) and $150-170mn in maintenance capex, $80-90mn of taxes (15% average tag rate) leaving ~$450mn in distributable FCF. So even on relatively conservative assumptions, AMR can fund the repurchase of ~10% of its current market cap. each year. Furthermore, there is a lot of operating leverage in this model, for example in FY22 AMR did $1.7bn in adj. EBITDA and $1.3bn in FCF with avg. realised met. coal price of ~$240.

Shareholder returns: AMR has been aggressively buying-back stock and indicated that the most recent dividend will be its last. It has a $1.5bn buy-back program in-place with $940mn executed to Nov-23. This has shrunk the share count by 28% since Mar-22 and this is likely to be the primary route fo value creation going forward. ESG mandates and Mag-7 obsessions has led to continued outflows from these kind of stocks. AMR is effectively using this technical to its advantage and buying back shares at an attractive price. Under relatively conservative asssumptions I think its possible for AMR to buy-back >50% of its stock over the next 5 years. If met. coal prices are more in the $200 range AMR could get there in 2-3 years.

Risks

Environmental concerns/government intervention: of course there are many potential unknowns here. An environmental disaster or further government intervention in the sector are risks.

Material supply/economic downturn/coal price weakening: energy and steel making are highly cyclical. A downturn would have a significant impact on pricing and thus FCF and the share price.

Credits, sources and where to find more

I originally came across the idea via Mohnish Pabrai’s 13F. However

has written a few posts on it, an example here.I’d also recommend subscribing to

Happy hunting,

The Geez

Great write up! Check out NRP if you like AMR