Diversified Energy (DEC LN)

Diversified Energy’s (DEC) is an interesting one, I’m either going to be very right or very wrong. The stock trades almost absurdly cheap with a dividend yield of ~30%. The company acquires declining PDP (proved, developed, producing) onshore natural gas wells from larger producers and attempts to earn its return by squeezing more out of the wells at hedged forward rates and cost-efficient well closures.

Initially, the name ticked a lot of boxes for me: unloved dirty, declining assets, anti-ESG, small cap (<$1bn), misrepresentations in the press (see below) and an unpopular non-US listing all of which contributed to the discounted price. Furthermore, active buybacks and dividends offer a route to closing the discount to intrinsic value. However, the stock has kept getting cheaper…! Further environmental concerns, press reports, some short reports and weak natural gas prices have continued to weigh on the stock.

I’ve averaged down in this once already. I’m still fully invested, while I have more concerns with this one than the first 4 posted, I remain optimistic value will ultimately be realised.

Average entry price: ~£13.00

Current price: £9.35

Upside scenario: ~£15-£20 (+£2.8 p.a. Dividend)

Position size: ~£15k

Description

Diversified Energy’s (DEC) is a London (and recently US listed) oil and gas producer. The business primarily produces onshore natural gas in the Appalachian basin and the “Central Region” (Texas, Louisiana, Oklahoma) and by well count it is one of the largest in the US (~70k). The wells are predominantly conventional (i.e. not shale) and and past peak production.

Investment thesis and catalysts

Adding value: disciplined M&A, reducing decline rates, managing costs and efficient closures. The business case for DEC is relatively simple. It acquires mature declining wells from drillers at discounted prices and attractive financing. DEC then executes its best operational practice to reduce decline rates. The asset retirement obligation (ARO, more on that later) can thus be pushed-out and also managed at lower cost given in-house well closures and geographic concentration. DEC has acquired assets at an average of 2-3x EBITDA. So why can DEC acquire at such attractive multiples? These assets are predominantly, non-core, small, declining and with significant AROs. For the majors it is not worth squeezing the extra few percent out of the well with more attractive IRRs in new wells and shale.

Managed commodity risk: DEC doesn’t take drilling or exploration risk. These risks are taken by the initial developers of the wells, and DEC acquires the assets from them after the most productive years have passed. This is called “PDP” or proved developed producing wells. Furthermore the company takes a conservative approach to forward hedging sales as indicated below. Thus in spite of pressured natural gas prices, returns are relatively well hedged.

Shareholder returns in focus: DEC has historically been a large dividend payer and chipped away at the shares in the market. Since going public in 2017 the company has returned >$800mn in dividends and buybacks. For context the 3Q interim dividend (to be paid 28 Mar) amounts to $42mn, on a ~$560mn market cap. The company is running with a 30% annualised dividend yield. Furthermore, given the depressed share price the company has offered to buy-back shares at a 5% premium in lieu of a dividend if shareholders elect to do so. Buying back shares at these levels looks incredibly accretive.

“The directors believe that the current trading price does not reflect the quality of the company’s assets”

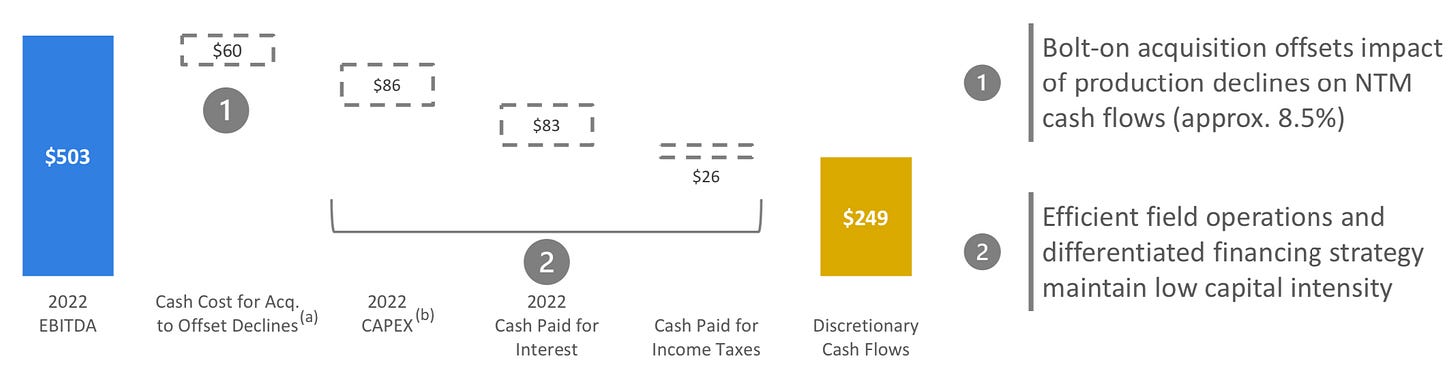

Valuation and debt: High level FCF is illustrated above based on FY22. In FY23 the company is guided to come in at $540-545mn EBITDA (vs. ~$560mn market cap.) A disposal and lower hedged rates led to some concerns about dividend sustainability in 2024. Without M&A EBITDA is likely to fall to ~$375mn. DEC pioneered its fixed-rate, amortising, well-backed financing. Post a recent disposal, net debt totals ~$1.2bn which leaves an EV of $1.76bn (ex. $450mn of AROs) equivalent to a 4.7x FY23E EBITDA multiple. This is equivalent to a FCF yield of 30% and a dividend yield of 25%. Peers trade at an average of 6x EBITDA/12% FCF yield/6% dividend yield. Re-rating to 5.5-6.0x EBITDA would be equivalent to £14-£17 per share (last: £9.35), while in the next year shareholders should receive £2.8 in dividends.

Insider ownership: DEC was founded in 2001 by its CEO Rusty Hutson and is HQ’d in Alabama. Rusty has never sold a share in DEC and still owns 2.5% of the stock. While hardly huge, it creates some alignment.

Press, short reports, environmental concerns: So you must be thinking, why on earth is this trading so cheap? Negative press, congressional letters, environmental concerns and some short reports have combined to pressure the share price. The issues started in with an article published by Bloomberg Green journalists in 2021. Most of the subsequent issues have essentially been a rehash of that. The journalists visited 44 wells (<0.0005% of DEC’s wells) and used a hand-held sniffer and thermal imaging camera. Across 60% of the wells they found that some methane was leaking. This is a real problem and there is an environmental risk with neglected or abandoned O&G infrastructure. However, DEC has responded (repeatedly) in a detailed and comprehensive manner (see letter responding to congress). In reality DEC is one of the leading companies at addressing these issues. All O&G companies suffer with methane leaks, the issue is the extent of it, how it compares to regulations and their own disclosures. The amount recorded was actually the same as registered in their 2021 sustainability report. For all my skepticism of such measures for most companies, DEC has made significant efforts on the ESG front in recent years. It has an MSCI ESG score of AA from single-B just three years ago (no mean feat for an old school Nat. Gas producer). It’s Scope 1 methane intensity has fallen by almost 25% since 2020 to 0.21% only a fraction above the 0.20% IRA threshold. It has implemented a systematic fugitive emissions program including 174,000 handheld well inspections and has 11,000 miles of midstream assets monitored under aerial lidar. It achieved OGMP 2.0 Gold Standard in 2022 by the UN’s methane Partnership, one of only 5 US firms to receive the designation. Furthermore, DEC has built a substantial internal well plugging business which accounts for more than 40% of Appalachia basin capacity and has materially exceeded its well plugging commitments each year. In addition the business assists states in plugging third party orphan wells. For example in 2023 DEC retired 384 wells, of which 200 were DEC wells (well in excess of state requirements) and 184 for outside parties. The revenues from outside parties offset its own well closure costs. In summary, DEC appears to be acting in good faith and as a responsible steward for the assets. Indeed it appears to be a leader in the space and part of the solution. We see DEC’s interests, and that of its shareholders, as well aligned with addressing environmental concerns. The reaction of the stock price to the headlines seems extreme.

Risks

Environmental concerns/government intervention: while I think any action by Congress is unlikely given the above, it cannot be ruled out.

Higher well declines or persistent weak Nat Gas price: higher well declines or prolonged weak natural gas prices could continue to weigh on the stock.

Credits, sources and where to find more

I originally came across the idea on the Yet Another Value podcast hosted by Andrew Walker (orYet Another Value Blog) with guest Andrew Carreon of Emeth Value - link.

You can see an Emeth Value letter here.

There is also a detailed post on Value Investors Club here (2021).

Happy hunting,

The Geez