I’ll keep this snappy and to the point. I came across it via a friend who is invested, there is a good write-up on MicroCapClub as well (paid). I’m considering a position in the near future, subject to some further due diligence. This would always be small for me, way outside my circle of competence. I welcome any constructive criticism. As ever I’m writing this out as part of my own process, this is not a recommendation, DYOR.

What is it? Alpha Cognition is a pre-revenue pharmaceutical company (don’t laugh). Its flagship product is ZUNVEYL. However, unlike most other pharmaceutical plays, there is no regulatory approval risk - this has already been cleared by the FDA. There is patent protection to 2044.

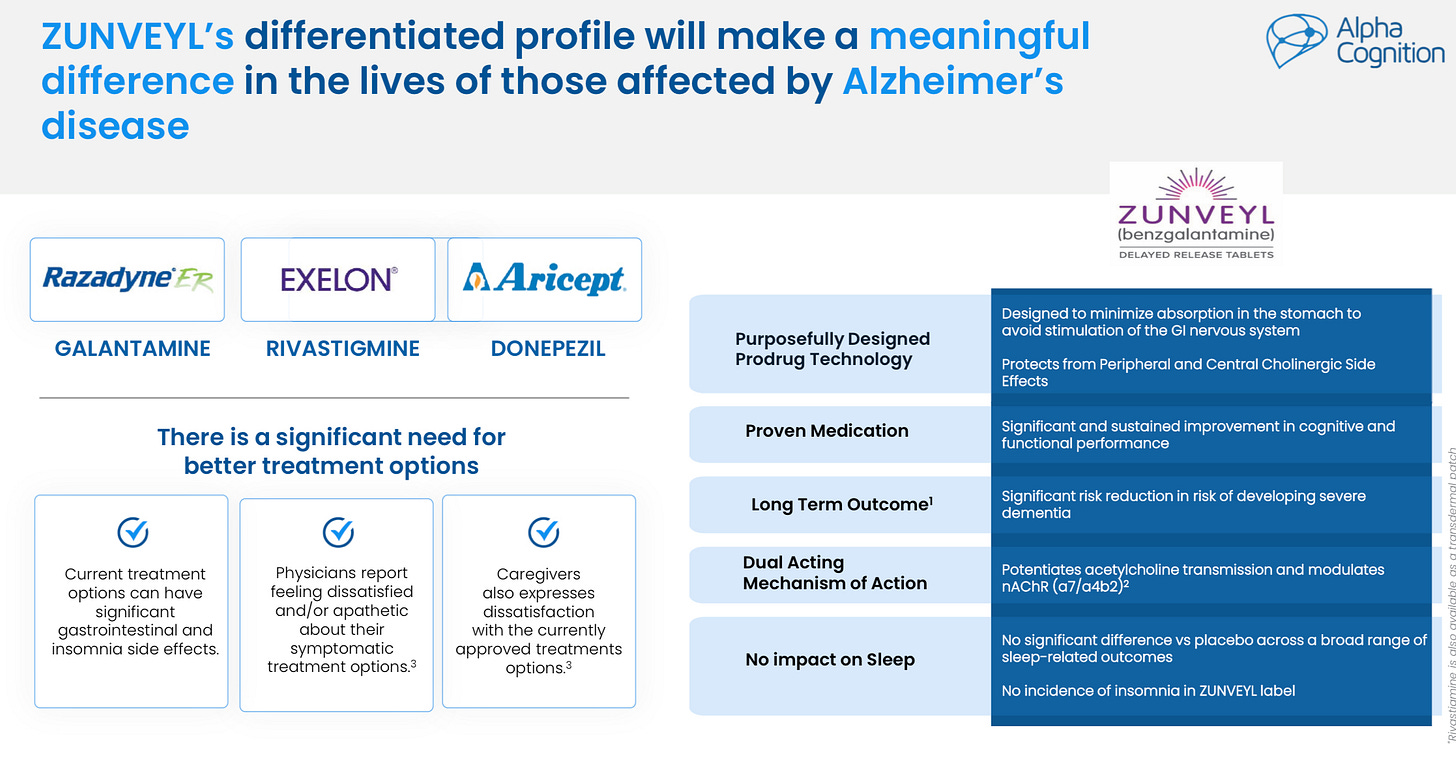

What’s the product? ZUNVEYL has been approved for mild-to-moderate Alzheimers. It received accelerated approval as its a modified generic form of the already approved (and effective) Benzgalantamine. The issue with Benzgalantamine is the vast majority of patients suffer from some pretty unpleasant side effects: insomnia, nausea, vomiting and diarrhoea. As a result, in spite of its efficiacy many patients can’t tolerate it, 55% of patients discontinue their treatment. Here’s where ZUNVEYL comes in, it claims to fix the problem: it is still an oral tablet but the drug remains inactive while in the digestive tract and only later does the liver metabolise it.

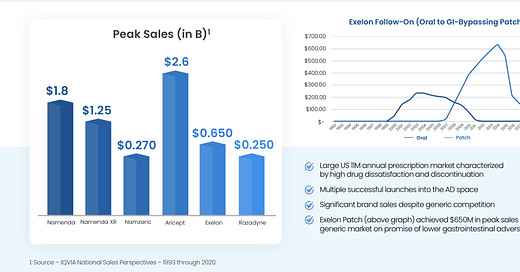

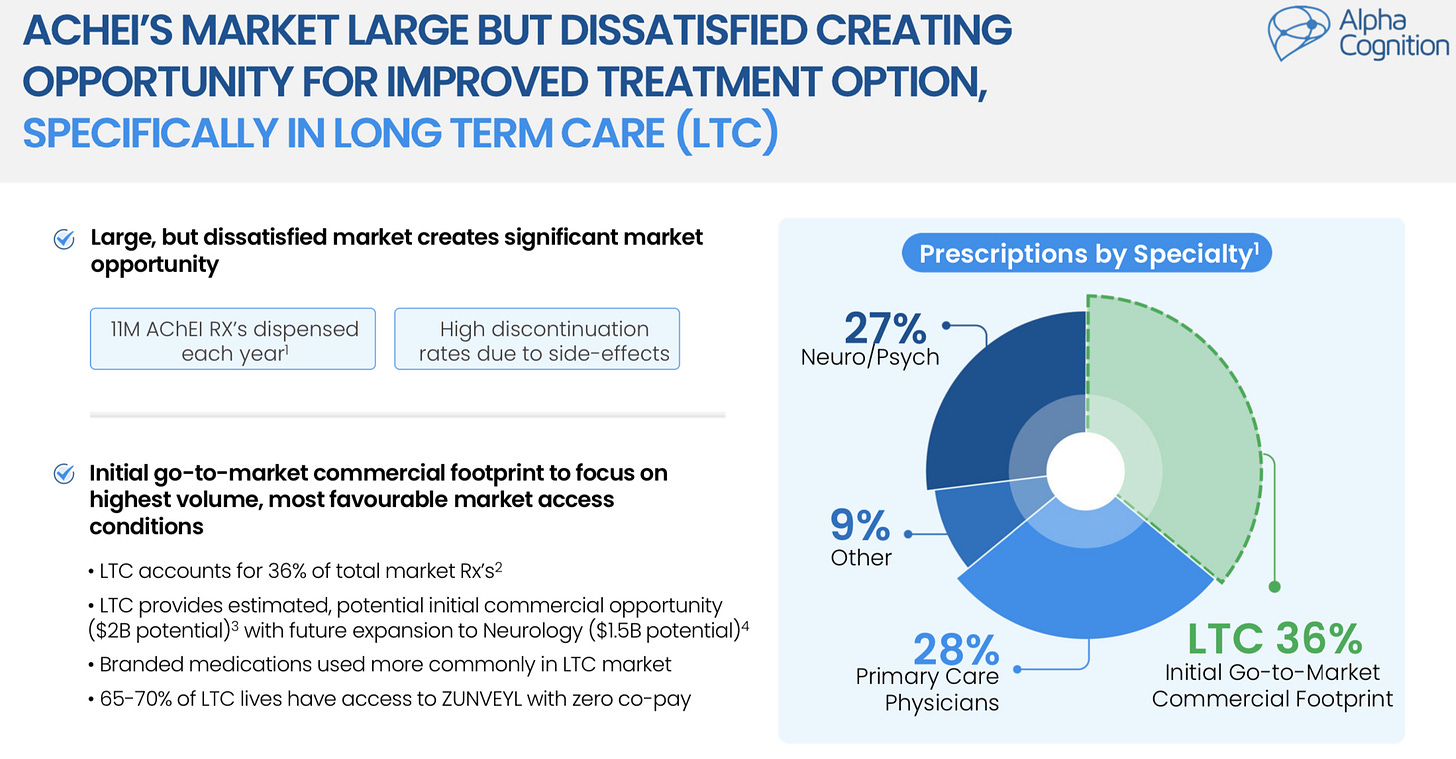

What’s the opportunity? The drug will launch in 1Q25. The US has 11m annual ChEI (of which ZUNVEYL will be one) prescriptions to treat alzheimers/dementia. Management are initially targeting the long-term care market (LTC, care homes) which they estimate at ~36% or ~$2bn (based on ~$500 average market prices). In the future Neurology will also be targetted, another 27% of the market. The LTC market offers several advantages: 1. it is geographically concentrated, enabling much greater leverage for the sales force, ACOG has 33 people to cover >80% of the market. 2. around 65-70% of residents are eligible for Medicare and Medicaid and have zero copays.

How is it capitalised? ACOG recently up-listed to the Nasdaq and successfully raised $54.5mn. Thus it appears to have runway with no significant risk of near-term additional dilution.

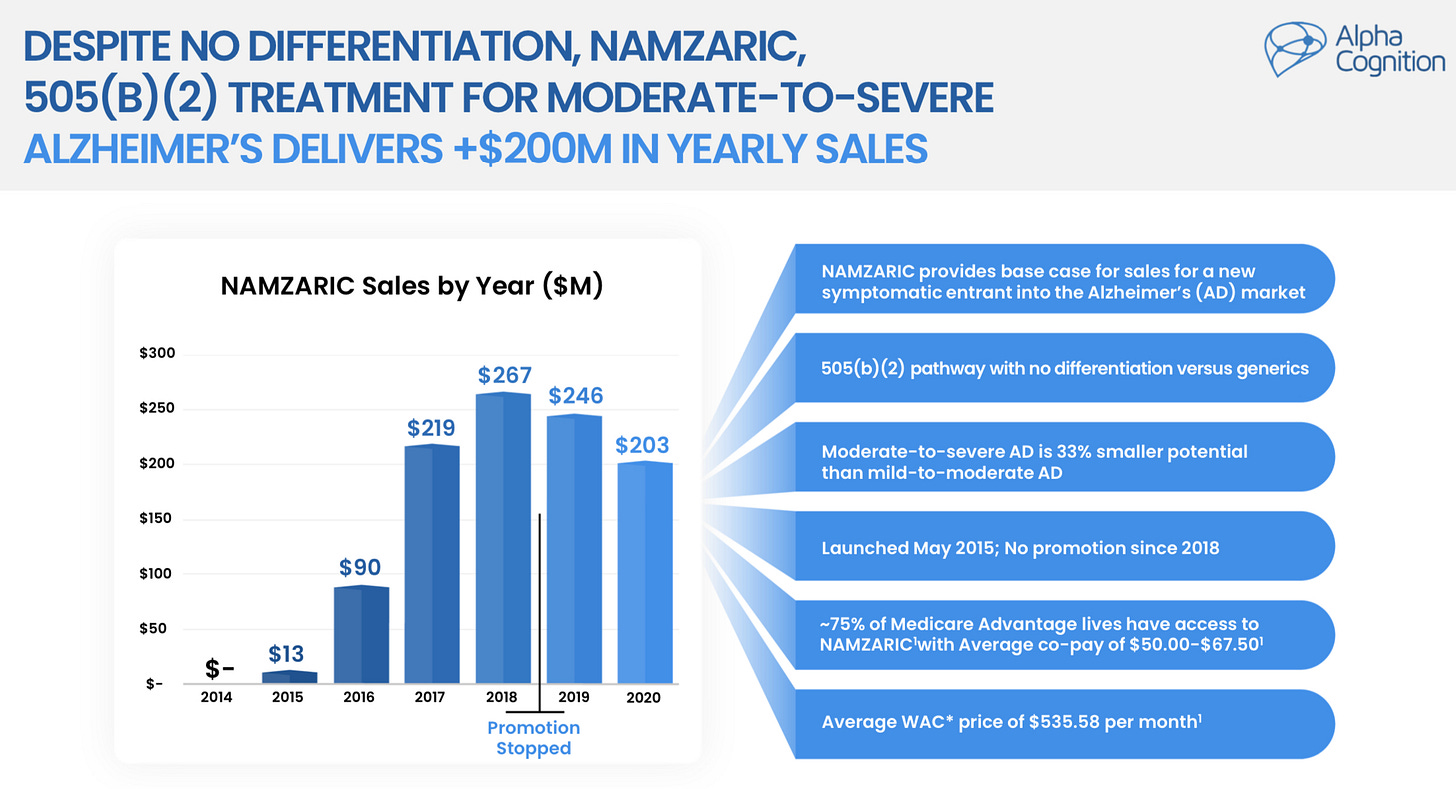

How to think about valuation and upside? Fully diluted share count (including warrants, converts, stock options) is ~21.0mnm, share price is $5.7 for a market cap of $120mn. NAMZARIC (see below) is the best comp. It peaked at 10% penetration. This is too conservative given its complete lack of differentiation. So let’s assume, and I still think this is conservative, 20% market share solely of the LTC market, so ~800k scrips. Pricing has been set at $750. So that makes ~$600mn of revenue. We are, for now, not considering any potential for market expansion, which is possible given the improved tolerability. In terms of COGS, lets assume 20% of sales, so $480m gross profit. Management has guided for $35mn of opex at peak sales. So EBITDA of $445mn. Let’s say it follows a similar path to NAMZARIC and reaches peak 5 years post launch and we value it at 8x EBITDA, discounted at 20% to today gives us an EV of $1.4bn. The current market cap is ~$120mn. You can play around with the market share numbers, timing, multiples to get to your own number, but clearly there’s room for material upside. Furthermore, we haven’t even considered the markets beyond LTC or further upside options from international licensing agreements: it has already agreed a deal initially worth $44m in upfront and milestone payments for China. In addition it is eligible to receive royalties. Japan is an obvious next step.

Who runs it? CEO Micahel McFadden and COO Lauren D’Angelo have both had experience with successful commercial launches and exits: Anavir and Urovant which sold for $3.5bn and $585mn respectively. Collectively management have experience in over 140 product launches.

What are the risks? Management don’t appear to have a lot skin in the game. Insider ownership looks low and thus further dilution is a higher risk and possible anway down the line. There is obvious execution risk around bringing the product to market in a successful manner. Competing products or alternative treatments. Labelling cannot include the reduced GI effects, as this has not been proven in a trial setting. It will require clinical, real world experience.

As a reminder this is primarily an investment journal, this is not financial advice or a recommendation. All of the ideas are plundered from other (cited) sources. I simply own the stock at the time of writing. Please refer to the disclaimer at the bottom or my introductory post for further details.

Ticker: ACOG US

Current price: $5.7 (3-Feb-25)

Upside scenario: $30-$50 (+5-9x, 3 year horizon)

Credits, sources and where to find more

I continue to recommend a subscription to MicroCapClub where I first came across this: ACOG by Jordan Salim. Jordan has done a far more diligent write-up than me.

The company recently hosted an investor day, see presentation here and full investor deck here. This is where I have gathered most of the above information.

Happy hunting,

The Geez